Inside the World of Luxury Fix & Flips: Roberto Bolona of Brenner Cox™ on Speed, Precision, and 33% IRRs on 9×90™ (#54)

Listen to this episode using your favorite app

⚖️ Legal Disclaimer

All opinions expressed by the guests are their own. 9×90™ and its affiliates do not endorse or guarantee any specific outcomes discussed in this episode. This podcast is for informational and entertainment purposes only and does not constitute financial, legal, or investment advice. Listeners should conduct their own due diligence and consult with professional advisors before making any investment or business decisions. Nothing discussed in this episode constitutes an offer to sell, or a solicitation of an offer to buy, any securities. Any such offer or solicitation will be made only through official offering documents and to qualified, accredited investors, in accordance with applicable securities laws. The views expressed by guests are their own and do not necessarily reflect those of the host or 9×90™.

About this episode

What if your next real estate investment didn’t take years to yield returns—and came with white-glove service, real-time reporting, and a team that can flip three luxury mansions faster than most contractors finish one?

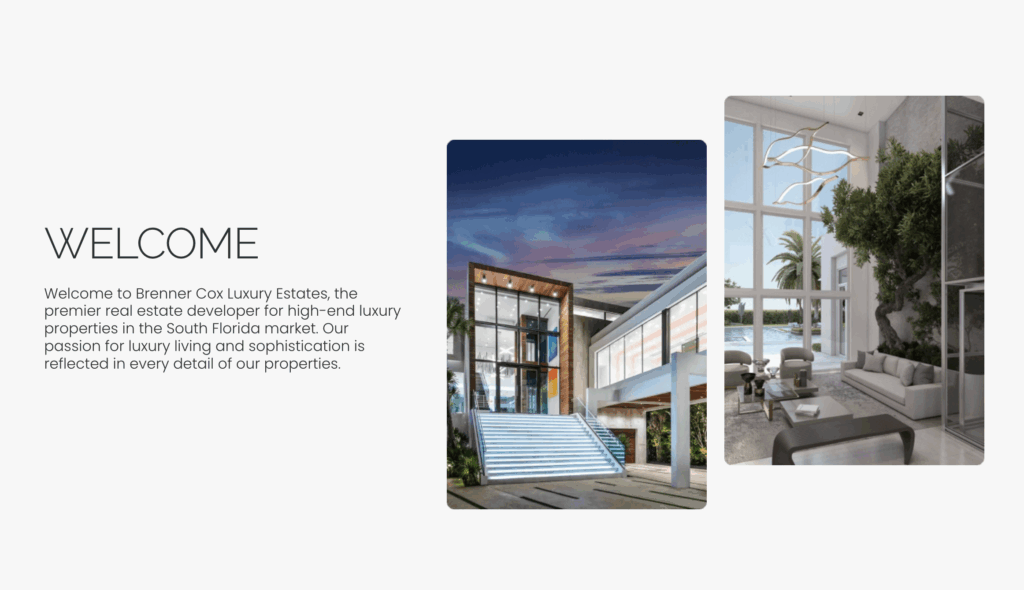

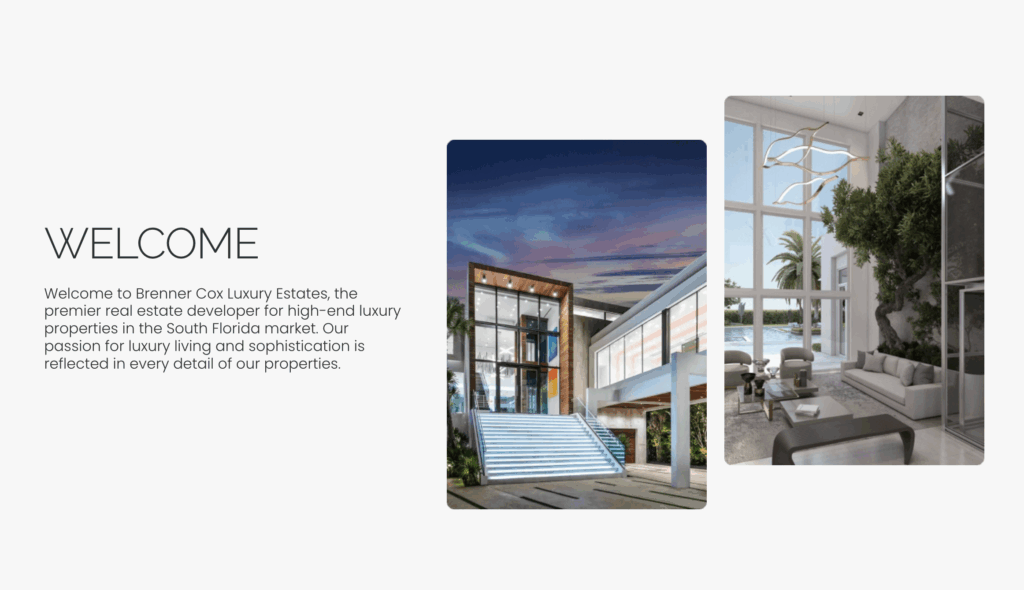

In this episode, Adi Soozin interviews Roberto Bolona, CEO of Brenner Cox™ the favorite Luxury Real Estate Development company of investors. Brenner Cox™ is the secret weapon behind some of South Florida’s most profitable, high-speed luxury mansion flips (don’t believe me? checkout the images below). In this episode Roberto reveals how his team transformed a $1.1M teardown into a $10M mega-estate—with precision upgrades that included a custom gym, guest house, and basketball court.

In this episode you will hear how Brenner Cox™ offers an average of 33% IRRs to their investors in as little as 12 months. While most flippers lose money hiring cheap & incompetent contractors, Roberto’s team keeps elite investors at the top of their game with rapid turn-around times and real-time updates—so they can be on top of their investments without ever needing to lift a finger.

From integrating Ferraris into home theaters to building in the most exclusive zip codes, this team turns wild ideas into sold-out homes and seven-figure returns.

If you’re investing in luxury real estate—or want to start doing it smarter, faster, and more profitably—this episode will change how you evaluate your next deal.

About this guest

For those of you who do not know Roberto, he has

- Built over $50 million in real estate transaction volume, with a decade of experience acquiring and developing luxury properties in Florida, Illinois, Tennessee, Missouri, and Arizona (multifamily ventures).

- Recently, his firm sold a luxury Southwest Ranches estate for $7.2 million, showcasing his success in high-end South Florida developments.

- Often referred to as the #1 luxury home builder in Southwest Ranches, Brenner Cox has delivered marquee mega‑estates—such as the 14,000 sq ft showpiece valued over $10 million.

- He co-founded both Monumental Real Estate and Brenner Cox Construction Management, reinforcing his leadership as both visionary developer and managing partner.

Connect with this guest

- Website: www.BrennerCox.com

- LinkedIn: https://www.linkedin.com/in/roberto-bolona-44a76837/

- Instagram: https://www.instagram.com/roberto.mbcapital/

Show Notes Generated by Gemini

These show notes were generated by AI

00:00 – Meet Roberto Bolona & Brenner Cox™

Adi Soozin introduces Roberto Bolona, CEO of Brenner Cox™ Luxury Construction, known for completing three luxury flips in the time it takes other contractors to finish one—without sacrificing quality. Their name has become synonymous with speed, precision, and profitability in South Florida’s high-end market.

00:03:37 – Case Study: $1.1M Teardown to $10M Sale

Roberto shares the story of a 14,000 sq ft estate in Southwest Ranches—purchased off-market, demolished, and rebuilt. It initially sold for $7.2M, but strategic upgrades like a guest house, gym, pool extension, and basketball court enabled a resale at $10M—adding $3M in upside with just $1.2–2M in cost.

00:06:29 – Investment Structure & Returns

Brenner Cox™ operates as GC, developer, and investment partner. For LPs, they deliver average 33% IRRs in 12–18 months, with a $100K minimum investment—designed to remain accessible due to Bolona’s own immigrant roots and focus on wealth building.

00:11:10 – The Ritz Carlton of Construction

Adi likens their client experience to a five-star resort. Roberto explains how investors receive white-glove service, with weekly site photos, budget tracking, milestone updates, and fast responses via WhatsApp—usually within an hour.

00:14:11 – Deal Flow & Investor Access

Bolona walks through how investors get notified about new opportunities: time-sensitive, no-fluff emails with quick decision windows. They’re highly selective—only 5% of deals pass their rigorous filter.

00:16:34 – Mistakes That Kill Flips

Biggest error in luxury flipping? Choosing contractors based on price over precision. Bolona explains how cheaper bids lead to delays, missed market windows, and ultimate losses. Time is money in this game.

00:21:14 – Managing Teams Without Burnout

Learn how Brenner Cox™ keeps crews efficient without burnout—through clear systems and dedicated teams for planning, execution, and finishing. Loyalty is reinforced with thoughtful gestures, like taking the team to the FIFA Club World Cup.

00:30:27 – VIP-Level Transparency

For hands-off investors, Brenner Cox™ provides real-time reporting, weekly visuals, and budget breakdowns—so you always know your money’s working, even if you’re halfway across the globe.

00:32:47 – Ferrari in the Home Theater? Sure.

Roberto reveals wild client requests—like integrating a Ferrari into a private movie theater—and how they balance vision with functionality and long-term property value.

00:35:22 – How They Vet Every Deal

From design psychology to financial runway, every project goes through intensive stress-testing. They work with top agents and brokers to ensure big margins and protect against macro-level market swings.

00:41:54 – Location. Location. City Hall.

Why real estate still comes down to location—and relationships. Bolona breaks down how strong ties with local officials (and a smart permitting strategy) can make or break a project, especially in tertiary markets.

Transcript

This transcription was generated by Gemini & edited by ChatGPT

Adi Soozin:

Today, I’m joined by Roberto Bolona, CEO of Brenner Cox™ Luxury Construction. Roberto is known for his exceptional work in high-end fix and flips in South Florida. His team has a reputation for completing three luxury renovations in the time it takes most contractors to complete one—and they do it without compromising on quality.

Roberto Bolona:

Thank you, Adi. That’s exactly right. We’ve built a system that allows us to move at speed while still maintaining luxury standards. We focus on precision, discipline, and results.

Adi Soozin:

You’re known not just for speed, but for profitability. Can you walk us through one of your recent projects?

Roberto Bolona:

Absolutely. We recently acquired a 14,000-square-foot mega estate in Southwest Ranches off-market for $1.1 million. We tore it down completely and rebuilt it from the ground up. The original plan was to sell at $7.2 million, but we added features like a basketball court, pool extension, guest house, and gym. That allowed us to upsell the property for $10 million. So, we generated an additional $3 million in revenue with an investment of just $1.2 to $2 million.

Adi Soozin:

Incredible. Let’s talk about the investment side. How does Brenner Cox™ structure these deals?

Roberto Bolona:

We operate in three capacities: as a general contractor, a developer, and an investment partner. For those coming in as limited partners, we offer an average return of 33% IRR over 12 to 18 months. And we’ve never lost a dollar for an investor. The minimum investment is $100,000, and we’ve kept it there intentionally. I come from humble beginnings as an immigrant, and I wanted to give more people the opportunity to be part of this.

Adi Soozin:

That accessibility is rare at this level. And the investor experience you offer—can we talk about that?

Roberto Bolona:

Definitely. We treat our investors like VIP clients. Think of it as a Ritz Carlton-level experience. They get real-time reporting, budget tracking, weekly site photos, and direct communication through WhatsApp. We typically respond within the hour. We know our investors are busy, so we keep it seamless and proactive.

Adi Soozin:

How do you handle communication around investment opportunities?

Roberto Bolona:

We send short, time-sensitive emails to both new and existing investors. Timing is everything in this business. If a decision is delayed, it can hurt the entire project—so we move fast. We also don’t take every deal. In fact, we only move forward with about 5% of the deals we evaluate.

Adi Soozin:

Let’s talk about mistakes. What’s the number one error you see in luxury fix and flips?

Roberto Bolona:

Without a doubt, it’s hiring contractors based on price instead of precision. A cheaper contractor usually ends up costing more in the long run—delays, miscommunication, and missed opportunities eat into your margins and hurt the entire deal.

Adi Soozin:

Exactly. Every extra month in renovation costs the owner in time, money, and momentum.

Roberto Bolona:

Right. Time is the most expensive variable in real estate. We’ve created systems to protect against that.

Adi Soozin:

And how do you maintain that level of speed and quality without burning out your team?

Roberto Bolona:

It comes down to structure. We have dedicated teams for planning, execution, and finishing. Everyone knows their role. And we take care of our team. I recently flew the crew to a Club World Cup match just to show appreciation. Loyalty comes from feeling valued—not just paid.

Adi Soozin:

For the hands-off investors listening, can you describe what reporting looks like?

Roberto Bolona:

They get full transparency. We share milestone updates, budgets, and weekly photos and videos. We don’t force investors to engage if they don’t want to, but we give them enough visibility so they feel confident every step of the way.

Adi Soozin:

You’ve also had some pretty wild design requests. Any standouts?

Roberto Bolona:

One investor wanted to integrate a Ferrari into their private movie theater—literally. It was more of a branding element. We made it happen but also made sure it didn’t compromise the garage space or resale value. We always balance vision with function.

Adi Soozin:

It’s not just about aesthetics—it’s about protecting the property’s equity, too.

Roberto Bolona:

Exactly. We’re not building theme parks. We’re building assets that need to hold value.

Adi Soozin:

How do you evaluate potential flips?

Roberto Bolona:

We look at both design psychology and the financial runway of each project. Every market is different, so we consult with local brokers and agents. We stress-test deals for macro shifts. That’s why we only pursue a small percentage of what we review.

Adi Soozin:

And of course, the golden rule—location.

Roberto Bolona:

Location is everything. But so are your relationships with the city and county. We often work through attorneys or long-standing connections to streamline permits and approvals. If you can’t execute efficiently, it doesn’t matter how good the deal looks on paper.

Adi Soozin:

And obviously, you want to make sure you’re able to actually help people with what they’re asking for. If the form is too generic, people will ask for everything under the sun—even things they don’t really want or need.

Roberto Bolona:

Correct.

Adi Soozin:

Just to clarify for anyone unfamiliar with Brenner Cox™, think of it like this: It’s the Ritz-Carlton versus the Hilton. At the Ritz, they’re trained to anticipate and fulfill your every need. If you want water, it’s there. If you need something they don’t have, they go out and get it for you. That’s the level of care you get with a renovation from Brenner Cox™.

With most general contractors, it’s like staying at a budget hotel—you’re basically just getting a bed. You’re expected to manage everything yourself.

Adi Soozin:

You’re getting a headache. You have to follow up constantly on timelines, micromanage the contractors, and I know people who’ve had to sue their GCs because they simply stopped showing up—probably because they found a better-paying job somewhere else.

With Brenner Cox™, you get the Ritz-Carlton treatment. You hire them for a project, and it’s completed in record time. The results are stunning, there are no headaches, and it’s minimally invasive because they understand they’re working in your home. So if someone is filling out that form, it’s because they want that kind of premium, concierge-level experience.

Roberto Bolona:

That’s exactly right. And yes, I can hear you—had a little bit of a connectivity hiccup, but I’m good now.

Adi Soozin:

You’re back!

Roberto Bolona:

Perfect. You nailed it. We offer a true white-glove service, especially on the investment side. We provide real-time reporting so investors always know what’s going on. And we’re actually open to suggestions—if an investor has a background in construction or design and wants to suggest a material or design element we may not have considered, we’ll listen. We want our investors to feel heard.

Communication is key. We provide real-time updates on everything, and we communicate via WhatsApp. We have a company-wide rule: we don’t take longer than one hour to respond to any investor inquiry—even if we don’t have the answer yet, we’ll acknowledge the message. That level of responsiveness is a big part of how we differentiate ourselves from other contractors.

Roberto Bolona:

Honestly, the Four Seasons might be in that comparison too. I love it there. But the point is, our reputation is everything. And when someone wants to know what opportunities we have available, we send out very short, time-sensitive emails. Anyone can go to our website, fill out a form, and we’ll send them new opportunities.

These deals move quickly. We’ve had a core group of investors with us for a long time, and we always welcome new ones. But if we announce an opportunity that needs to be funded within a week, we expect quick decision-making. We encourage investors to jump on a call, have their attorneys review everything—but if someone delays, we move forward without them. We don’t wait weeks.

Adi Soozin:

That makes sense. Your whole value proposition is ultra-high quality and speed. You can’t keep that pace if you’re spending five months onboarding someone new who’s unsure or hesitant. And meanwhile, your existing investors are wondering why their capital isn’t being deployed.

Roberto Bolona:

Exactly.

Adi Soozin:

Especially since they’re used to seeing 30% returns in just a few months to a year. Delays compromise the entire model.

Roberto Bolona:

Correct. If we can’t fulfill a deal with the right investor at the right time, we simply move on. But that’s rarely the case.

Adi Soozin:

So what’s the number one mistake you see when it comes to people hiring contractors for luxury flips? And how does your team solve for that?

Roberto Bolona:

The number one mistake is hiring based on price, not precision. You don’t need to be a construction expert to understand this—it’s like buying a car. If you only look at price and ignore the experience, you’re going to pay for it later.

When people choose a contractor who doesn’t respond, doesn’t show up on-site, and cuts corners—just because they were cheaper—they end up paying far more in delays, mistakes, and missed opportunities.

Roberto Bolona:

Real estate is cyclical. If your property isn’t ready when the market is hot, you lose the buyer. That buyer moves on to the competition. You might save a little upfront, but you could lose hundreds of thousands on the backend. That’s the biggest mistake in luxury flipping.

Adi Soozin:

Yeah, absolutely. The moment you buy an asset, the clock starts ticking. You want to know how and when that capital is coming back with a return.

Adi Soozin:

Every extra day in renovation is money lost—minute by minute.

Roberto Bolona:

Correct. And that’s where IRR comes into play. Time is a huge factor. You need time-efficient returns on that hard-earned money. That’s why we focus so heavily on speed and accuracy. We’re proud to say that 99% of our investors reinvest with us on future projects.

Roberto Bolona:

Hold on—technical difficulties. People are calling me again. Honestly, I don’t even know why I still have hair!

Adi Soozin:

[Laughs] I’m surprised too! Developers are supposed to be bald by your age.

Roberto Bolona:

You know, I met this developer from New York at a poker tournament in Vegas. We were at the Venetian. He was probably in his 70s—completely bald. I told him I was a luxury developer and he looked at me and said, “No, you’re not.” He literally said he’d believe me if I was bald.

Adi Soozin:

[Laughs] That tracks.

Roberto Bolona:

He even asked my age and said, “By that age, I was already bald.”

Adi Soozin:

Well, I think a lot has changed. We now understand the role of mental health and stress management in long-term success. There’s so much data showing that lower cortisol levels lead to clearer thinking and better outcomes.

So I’d argue we’ll see more developers our age keeping their hair into their 70s.

Roberto Bolona:

Okay, don’t say that—I don’t need more competition! Hair doesn’t build homes, but it helps.

Adi Soozin:

[Laughs] I’d say half the developers I work with still have their hair—and they’ve done really well. A few come to mind immediately: from New York, Ukraine, Russia… a couple in London, Israel…

Roberto Bolona:

Oh man. Where are they based? South Florida? New Jersey?

Adi Soozin:

Virginia and New York, mostly.

Roberto Bolona:

Alright. Just promise me if you meet any more, tell them there’s no more room for them.

Adi Soozin:

[Laughs] Deal.

Adi Soozin

I’m here with Roberto Bolona, the founder of Brenner Cox™, one of the most elite real estate construction firms in South Florida. His firm has a unique claim to fame: they can fix and flip three luxury mansions in the time it takes most contractors to complete just one—and they do it at a higher profit margin, without sacrificing quality. Roberto, thank you for joining us.

Roberto Bolona

Thank you for having me.

Adi Soozin

Let’s dive in. A lot of the audience watching this are fix-and-flippers, syndicators, and family offices. Can you walk us through a recent project that really shows your process?

Roberto Bolona

Absolutely. One of our most recent projects was in Southwest Ranches. It was a 14,000-square-foot estate we acquired for $1.1 million off-market. We demolished the entire house and built a new one from the ground up. We originally projected a $7.2 million resale value, but we ended up selling it for $10 million. The key was adding features like a basketball court, extending the pool, and building a guest house with a gym—those additions cost us only about $1.2 to $2 million and added over $3 million in value to the final sale price.

Adi Soozin

Incredible. And your firm doesn’t just operate in one role—you’ve got three different models, right?

Roberto Bolona

Yes, we work as a general contractor, a developer, and sometimes we take on investment partners. We’re able to structure deals flexibly depending on what our partners or clients need.

Adi Soozin

So for the investors who are listening—whether they’re looking for solid returns or they want a construction partner who can make their project profitable—how do you work with them?

Roberto Bolona

Most of our limited partners see around 33% IRR on a 12 to 18-month timeline. We’ve never lost money for any of our investors. The minimum investment is $100,000, which we’ve kept intentionally low. I’m an immigrant myself, and I wanted to give people a way to build generational wealth. We’ve had investors who started with $100K and now reinvest $1.2 to $2 million with us.

Adi Soozin

I love that. And I know from personal experience that working with your team feels like dealing with the Ritz-Carlton of construction firms. For the people watching—especially those who’ve had nightmare contractor experiences—what can they expect from working with your team?

Roberto Bolona

We take care of everything. From the very beginning—design, permits, construction management, high-end finishes—we handle it all in-house. Our team is full of perfectionists, and I’d rather delay a project by a few days than deliver something that doesn’t meet our standards. That’s why we’re able to move fast and deliver excellence.

Adi Soozin

So if someone brings you a property, when is the ideal moment for them to involve your team?

Roberto Bolona

Immediately. The sooner we’re involved, the better we can optimize the value-add strategy. We can walk the site, run numbers, bring in our architect and engineer, and give an honest breakdown of how much profit can be made—and how quickly.

Adi Soozin

And the earlier you’re involved, the fewer mistakes are made, which saves money in the long run.

Roberto Bolona

Exactly.

Adi Soozin

Roberto, thank you. I think a lot of investors are going to be reaching out after this.

Roberto Bolona

Looking forward to it. Thanks again.

Adi Soozin: You have to go bald. I can only have so many.

Roberto Bolona: Yeah. Exactly. Exactly.

Adi Soozin: Noted. So, you’re flipping three high-end properties in the time it takes others to complete one. How do you pull that off without burning out your crew or cutting corners?

Roberto Bolona: It comes down to a system. At the end of the day, it’s not just about working fast or throwing money at it. There’s a system in place. I have dedicated teams for each phase of the development—planning, execution, and finishing. For example, interior designers handle the design aspects, and our experienced construction supervisors and foremen are scheduled precisely when needed.

Everything is controlled, everything is planned, and everything is on time. In construction, we know delays happen—weather, vendors going under, or crews not showing up.

Roberto Bolona: So we have systems in place. For weather delays, we build in recovery time, maybe working Sundays if needed. For contractors who can’t deliver—maybe they started strong but lose capacity midway—we vet thoroughly, and our contracts allow for easy replacement if needed.

We’ve even accounted for micro-level disruptions, like when TPS status was removed from many workers in South Florida. We had backup teams ready to step in. Replacing a crew might cost more, but time is more valuable.

Roberto Bolona: Usually, it’s just one trade being affected, not all. So we move quickly to stay on track. I also make sure to keep my teams rested and motivated. Recently, when the Club World Cup came to the U.S., I took a big part of my field crew to see Real Madrid play live. We were front row. They were ecstatic. I could tell from their WhatsApp profile pictures—all proudly wearing Real Madrid jerseys.

Adi Soozin: Doesn’t even matter who they played. The fact that they were watching Real Madrid live is enough.

Roberto Bolona: Exactly. Mbappé was there, Modrić was playing. That kind of moment meant a lot to them. It’s how I show I care.

Adi Soozin: Yeah. That’s huge. When I go into an organization and help them double, triple, or even quadruple their sales, people always ask how I do it. It’s simple—I figure out what the team values, and it’s rarely just salary.

Back when I worked at Apple, I had this one DJ coworker. I was modeling in Italy at the time, and he asked if I could bring the models I worked with to one of his sets. I said, “Okay, if you sell the most MacBooks this week, we’ll make it happen.”

Adi Soozin: He won. So we all showed up—me and a bunch of absolutely gorgeous models. I was the least attractive one in the group! As soon as we walked in, his face lit up. He was bouncing in the DJ booth.

He bragged about it for weeks. After that, the rest of the team was like, “Wait, how do I win something from Adi?” So I’d ask like a godfather, “What do you want?” One guy wanted some random pastry he saw on Instagram. I’m awful in the kitchen—people call me a liability—but I told him, “If you break this record, I’ll figure it out.” He did.

Roberto Bolona: I would’ve loved to work for you. Experiences like that—honestly, they’re often more meaningful than a bonus. People want to feel close to the leadership. They want to feel appreciated. That’s why I do things like soccer matches, barbecues—you name it.

Adi Soozin: Yeah. When I first heard you were completing projects at triple the speed, I was like, “What is he paying them with—video games?!”

Roberto Bolona: If I brought in models, projects would be done in a week! But yeah, let’s stick to efficient systems.

Adi Soozin: Exactly. That kind of loyalty is how you move fast and keep quality. Loyalty is everything.

Roberto Bolona: Yeah.

Adi Soozin: It’s rare. At investor events, people always ask me, “What’s the rarest asset?” I tell them—loyal friends.

Roberto Bolona: Yep.

Adi Soozin: People say time is rare—but you can buy time. You can outsource more. You can’t buy genuine loyalty.

Roberto Bolona: That’s true. I hadn’t really thought about it like that, but you’re right. You can always make more money. You can outsource to save time. But loyalty—when someone goes out of their way not for a bonus, not for ego, just because they care—that’s irreplaceable. I always thank them when I see that. Great insight, Adi.

Adi Soozin: So, when working with hands-off investors, what kind of reports, timelines, and updates do you give them during a flip?

Roberto Bolona: We treat our investors like VIP partners, just like you said earlier. And while we welcome new relationships, it’s still about quality over quantity.

We provide real-time updates, budget tracking, timelines, milestones—all of it. Weekly photos from the site, and often videos too. Some investors don’t respond often, and that’s okay. Over time, they trust us more. So it becomes more like quarterly check-ins rather than constant back-and-forth.

Roberto Bolona: And their reaction is always, “That looks amazing. That looks badass.” Uh, and if the investor is not local, they’ll say, “When can I fly down there? When can I go and see it in person?” And so they get excited every single time. But we provide all of this information in real time and we don’t force investors to engage with us. But at least they have their information with them. So that gives them peace of mind that their money is being overseen.

Adi Soozin: Yeah.

Roberto Bolona: It’s being micromanaged. So that’s how we treat our VIP partners.

Adi Soozin: How often do you have it where someone is investing in you doing a flip of a mega estate and they see the work done and they say, “I want that in my house.”

Roberto Bolona: Yeah. Oh, lots of times. Lots of times.

Adi Soozin: So you started Cox because your investors were like, “I want that.”

Roberto Bolona: Yeah. Yeah.

Roberto Bolona: And I’ve had also scenarios where I’ve built crazy things too. I’ve put a Ferrari in a movie theater. I put a Lamborghini on a pool.

Adi Soozin: No. Yeah.

Roberto Bolona: Crazy, crazy stuff. And some of those calls from an investor might come at midnight, 1:00 am, 2 am, and they’re like, “Listen, I have this great idea.” For them, it’s exciting and I love it. Ultimately, no one cares more about building something for their house, right? That is theirs that they can show their artistic side and later on show it off to their guests.

So I had an investor who purchased a home and called me later on at night—maybe 1:00 a.m.—and we started going over schematic designs to put a Ferrari inside a movie theater because he loves to watch Formula 1. My first reaction, and I’m always very honest, was—

Roberto Bolona: Can I curse on this podcast?

Adi Soozin: Yeah.

Roberto Bolona: You’re f****** ludicrous. I told him that because first of all, I was asleep, and secondly, he was losing space on his garage to make all this. That was a worry of mine. Where is he going to have more garage?

Ultimately, I think of my clients as: every dollar you put in, I want you to at least get that dollar out or have equity on it. So if you put a million dollars on a pool—which is a ludicrous amount—I want you to have 10% on top of it or something along those lines. Same with the movie theater.

Within a week, I had already sketched something with a lift, a system, and fireproof glass so that every time he watches Formula 1 in his movie theater, there’s a big projector and to his left is a glass case with a Ferrari backlit with colored lights.

Roberto Bolona: It’s illuminated but dim, and he can change the colors. So he can see his car while he watches Formula 1. People get excited, and I’m happy to provide that value.

Adi Soozin: Oh, that’s hysterical.

Roberto Bolona: I love the challenges when it comes to that. Do you want a Ferrari in your movie theater?

Adi Soozin: No, I’m good.

Adi Soozin: So, you’ve completed multi-million dollar flips across multiple states. How do you evaluate whether a luxury home is worth flipping in a particular neighborhood?

Roberto Bolona: We analyze the aesthetic opportunity and the financial runway on it. We look not only at design potential but also psychology—for that development. Every market is different—not just by state, but county, city, even neighborhood.

Ultimately, we ask: Will this home be aspirational? If yes, we build architectural plans and always assess the economic upside.

Roberto Bolona: Every part of that process involves local brokers and agents. We get their opinions to understand if there’s enough value to mitigate risk if the market changes on a macro level.

Adi Soozin: What kind of market changes?

Roberto Bolona: Like a 2007-2008 situation. We need to be ready. We have very firm financial parameters. If a deal doesn’t pass our stress test, we don’t go through with it. We’re very selective across different markets.

Adi Soozin: How many deals would you say you look at but pass on? What percentage do you actually move forward with?

Roberto Bolona: About 5%, I would say.

Adi Soozin: Yeah.

Roberto Bolona: I get a lot of meetings daily to analyze different deals. People who approach me can be investors, clients, developers, GCs—anyone. I evaluate the deal itself, the profit potential, and also the person bringing me the deal.

When others bring ideas, I almost always think: Why do they want to do this? If they’re hands-off investors who just want their money returned and bring an idea, my team evaluates it. For example, they might say, “I had a call last night, and I saw an empty lot in this area. I want to put most of the money there and expect X amount of return.” That’s great. I analyze it, but ultimately I present the pros and cons, potential pitfalls, and projected profits so we’re all on the same page.

Sometimes I have to say no. For instance, if the purchase price is too high, it’s not worthwhile. I’m not willing to start the entirety of the profit on a luxury flip at the purchase price. We’re very aggressive in that regard.

Roberto Bolona: So yes, about 5% is what I take on.

Adi Soozin: I had someone pitch me a deal last week—a surgery center in the middle of Ohio. I asked, “What’s the population size there?” She said, “Oh, it’s the Midwest.” There’s not much population, just two hours from the closest city.

Roberto Bolona: Right.

Adi Soozin: I said, “You’re pitching me this deal because I’m a blonde young woman? No one’s going to touch this.” She insisted it was a great opportunity. But if you don’t have a million people in the area, how many need surgery? Think about how rare that life occurrence is.

Roberto Bolona: Right.

Adi Soozin: It was just no demand there to make it worth it. If you told me you want to build a commercial building and lease offices to surgeons, that’s a different story.

Adi Soozin: I’d be like, “Okay, yeah, that makes sense.” But you’re telling me you want to have this whole building for surgeons and you don’t even have the population size to support that company staying in business?

Roberto Bolona: Right. Yeah. It’s a no-brainer.

Adi Soozin: Oh, yeah.

Roberto Bolona: Tertiary markets are very, very risky.

Adi Soozin: I don’t touch them. I don’t touch them.

Roberto Bolona: Yeah. And I would tell you something. I’ve made money in tertiary markets but very sporadically and only because the price or the cost per square foot was so low.

Adi Soozin: Well, you would. I wouldn’t. I would lose my shirt. Yeah.

Roberto Bolona: Because of a failing owner that I was able to take on. But I don’t—tertiary markets are so risky. As a matter of fact, not only does the operator fail in that particular case, but if you try to sell it, even if the market or interest rates go down and the cap rates get low, you might not move it. There might be very, very little demand.

Roberto Bolona: So location, location, location is what matters.

Adi Soozin: Yeah, the tertiary market’s barely connected to the economy.

Roberto Bolona: Yeah.

Adi Soozin: Yeah, it’s just too risky. Anyway, I thought that was funny.

Roberto Bolona: Yeah.

Adi Soozin: That was my first example off the top of my head of a s***** deal I got last week.

Roberto Bolona: Yeah. Yeah. That’s a no-go.

Adi Soozin: Okay. So, final question and then you can go. Let’s talk about the brand your estate trend. You kind of already started to brush on this with your friend wanting a Ferrari viewable from his movie theater. How can this design identity approach help flippers attract premium buyers faster? Or is this something so micro-niche that you really just do it for your investors when they see it done and want it done to their own property?

Roberto Bolona: That’s a good question. It’s simple to answer. In the luxury space, you’re looking at square footage like anything else, but you’re also looking at the entertainment area.

Adi Soozin: Okay.

Roberto Bolona: That’s from an athlete, from a basketball player to a hockey player to a baseball player, all the way to the CEO of a large corporation. They want to show up and show off their entertainment area. So the Ferrari example—I have done that, or at least cars within homes. What made me nervous in that example was the fact my client was losing garage space. Not that the idea was necessarily crazy, but yeah.

Adi Soozin: I love that you’re nervous and he’s not.

Roberto Bolona: Yeah. Exactly. Because I think when he tries to sell it, or thinks about costs, pragmatically you need garage space. Anyone buying that house will have at least four cars and two exotics. They don’t want a carport—they want an actual garage, especially in South Florida where we have hurricanes and lots of weather risks.

Roberto Bolona: At Brenner Cox™, we focus on brand. Our brand is what sets the tone.

Adi Soozin: It’s not just brand, it’s also trust.

Roberto Bolona: Yeah.

Adi Soozin: Like look at you. You’re worrying about your client’s garage. Any other developer would say, “Yeah, I’ll make that change because I’ll make even more money later when I have to change it back before selling.” You’re concerned about preserving the equity of their house more than they are.

Roberto Bolona: Yeah. That’s correct because I see them as long-term clients.

Adi Soozin: Yeah.

Roberto Bolona: If they trust me and ultimately sell and do well, they’ll come back to me. Or they might come back with part of the profits to invest in something else.

Adi Soozin: Yeah, that’s true.

Roberto Bolona: That’s the entertainment part. When you have a pool, your pool deck area must be at least three to four times as big as your pool, at minimum.

Roberto Bolona: The smallest pool size we try for is 60 feet long by 20 feet wide, and the pool deck area is three to four times that because there are simple technical answers to increasing the value of a luxury flip that we do at Brenner Cox. That brings multiples from 7 to 10 million where you can have a drone fly over and people wonder if this is a Four Seasons property.

Adi Soozin: Mhm.

Roberto Bolona: Partnering with the right designers would be my answer to that.

Adi Soozin: The house I grew up in, when my parents were looking to sell, the first few buyers were hoteliers who wanted to turn it into a hotel.

Roberto Bolona: Yeah. Did they?

Adi Soozin: It was 14,000 square feet. Each of them unofficially met with the town mayor to see about rezoning it into a hotel, and the mayor said no—we don’t want a hotel, especially not a luxury hotel here.

Adi Soozin: So what they ended up with—my parents were selling during a divorce, so not keeping that asset.

Roberto Bolona: Yeah.

Adi Soozin: The town ended up with a developer knocking it down. The mayor said, “This is a crown jewel, it’s stunning,” and the hoteliers said, “You told us no, so now you’re stuck with a developer who’s as stubborn as you are, and if you don’t want to keep the crown jewel in a way that benefits everyone, you lose it.”

Roberto Bolona: Yeah. So they ended up demolishing the house.

Adi Soozin: It’s in process. The developer owns it but the town won’t let them demolish it yet. They’re just sitting on it, waiting for it to collapse. Every once in a while they rip out more windows to increase wear and tear.

Roberto Bolona: Yeah.

Adi Soozin: It’s turning into a hot mess. They’re just torturing the town by not demolishing it, waiting for the town to ask them to.

Roberto Bolona: Yeah.

Adi Soozin: It’s now owned by a huge developer just sitting there like, “You wanted to give me a hard time? Okay, I’ll give you a hard time.”

Roberto Bolona: Yeah. Those are good examples of dealing with cities, permitting, and the strategies where you always want the city and county as partners.

Adi Soozin: Yeah.

Roberto Bolona: And have the right attorneys or relationships within.

Adi Soozin: Yeah.

Roberto Bolona: But if not, you do what you have to do.

Adi Soozin: I do a road trip along the East Coast a few times a year where I meet mayors who say they’re pro-development.

Adi Soozin: I ask, “Okay, prove it. Show me what’s been developed lately.” They’ll say, “Oh, this and that.” People ask, “Why are you so animated about making sure the mayor is pro-development?” Because I’ve seen firsthand a gorgeous estate go to ruins because the mayors were stubborn.

Roberto Bolona: Yeah.

Adi Soozin: But yeah.

Roberto Bolona: I’m happy for your parents in the sense they were able to sell it, hopefully for the highest price. It’s sad not to see something continue because the memories might be there if you buy it—you still see it. But that’s something you consider as a developer from the start: relationships with the city.

Adi Soozin: Yeah, they’re critical. I was toying with the idea of having an entire 9×90 season where mayors come on and tell you what they’ve developed.

Roberto Bolona: That’d be great.

Adi Soozin: I’ll push that out to them: “Come on the show and tell us what you want developed in your city.”

Adi Soozin: But yeah, ladies and gents, thank you so much for tuning in. I’ll include links to all of Roberto’s contact info—his LinkedIn, the Brenner Cox™ website.

Roberto Bolona: Yeah.

Adi Soozin: Do you want your Instagram included as well?

Roberto Bolona: Yeah, please.

Adi Soozin: He has a huge Instagram following. Do you have a separate website for investors, or should they just go through LinkedIn, Instagram, or Brenner Cox™?

Roberto Bolona: They should just go through LinkedIn or our website. Then we send out separate emails.

Adi Soozin: We’re working on a chatbot for his site so we can add an investor chatbot request. Sound good?

Roberto Bolona: Yes. That’s correct.

Adi Soozin: Okay, we’ll add that in. Thanks all for tuning in. See you next time.

Roberto Bolona: Thank you.

This interview was conducted by Adi Soozin, Best-selling author of Tools of Marketing Titans™, Managing Partner of Heritage Real Estate Fund, creator of Molo9.com.

If you are looking to build your name as an industry titan, we would love to help you. Fill in this application to get started: 9×90.co/apply-now, or start with our emails on bite-sized, high-powered marketing tricks:

Listen to this episode using your favorite app

⚖️ Legal Disclaimer

All opinions expressed by the guests are their own. 9×90™ and its affiliates do not endorse or guarantee any specific outcomes discussed in this episode. This podcast is for informational and entertainment purposes only and does not constitute financial, legal, or investment advice. Listeners should conduct their own due diligence and consult with professional advisors before making any investment or business decisions. Nothing discussed in this episode constitutes an offer to sell, or a solicitation of an offer to buy, any securities. Any such offer or solicitation will be made only through official offering documents and to qualified, accredited investors, in accordance with applicable securities laws. The views expressed by guests are their own and do not necessarily reflect those of the host or 9×90™.